Contents:

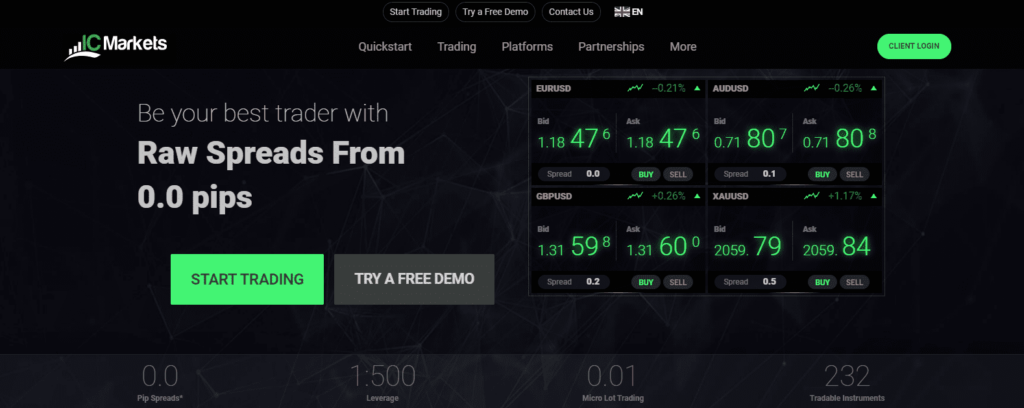

Keeping an eye on historical volatility when you are trading will help you adjust your trading strategy according to the volatility. High volatility in the price of an asset usually means it is risky. When you are trading such a market, you may have to use wider stop loss and take profit levels, as well as have sufficient margin in your account to avoid a margin call. Even though the trader may not know in which direction that they can expect the changes, the rate of change will be the same with future options.

Because option trading is fairly difficult, we have to try to take advantage of every piece of information the market gives us. At tasty, we often focus on implied volatility as the basis of whether there is opportunity for an underlying. When implied volatility is as high as it is currently, it’s pretty easy to find attractive trades. However, at some point, volatility will contract, and we will be left looking for trades. Because implied volatility is a measure of expected price changes, it is more difficult to quantify with precision than measures of pure volatility. So why is there a slight difference between our calculation and NSE’s?

Chris Butler received his Bachelor’s degree in Finance from DePaul University and has nine years of experience in the financial markets. Furthermore, historical volatility does not assess the probability of loss primarily, even though it can be used to provide an indication thereof. For example, if the HV rises, it means that a company’s stock or currency is getting highly volatile. Therefore, as a trader, you should dig deeper into the firm and see why this is happening.

Even with the different calendars, the most frequently used historical volatility measurement is HV 30, which translates to about 43 calendar days. Each index or stock has a unique level of volatility that changes over time. When historical volatility is high, it says that the stock has been showing extreme fluctuations in price. Comparing it to the historical volatility of other stocks and indexes allows one to estimate whether the stock or index is relatively volatile.

Does a Valuation-Based Portfolio Beat a ’Lazy’ One? – The Wall Street Journal

Does a Valuation-Based Portfolio Beat a ’Lazy’ One?.

Posted: Thu, 02 Mar 2023 15:00:00 GMT [source]

A full list of all implied volatility indicators can be found within the documentation pages for the Tradewell platform. And because the Tradewell is both a backtesting and analytics web app, traders can not only monitor these indicators, but also measure and analyze how changes in their values have historically impacted the future price of specific securities. However, question 2 in Section D.1 of SAB Topic 14 indicates that such exclusions are expected to be rare. The frequency of stock price measurement can significantly affect the expected volatility assumption. For example, volatility estimates vary depending on whether stock prices are measured on a daily, weekly, or monthly basis. While differences in annualized volatility estimates due to measurement frequency differences may be small, this is not always the case.

4 Expected volatility

Historical Volatility reflects the past price movements of the underlying asset, while implied volatility is a measure of market expectations regarding the asset’s future volatility. Historical volatility is also referred to as the asset’s actual or realized volatility. Usually, at-the-money option contracts are the most heavily traded in each expiration month. So market makers can allow supply and demand to set the at-the-money price for at-the-money option contract.

Studying changes in the volatility of an asset can help identify a normal volatility range, deviations from it, and subsequently, trading opportunities. Some companies may be tempted to exclude historical volatility data caused by extraordinary market conditions, such as the effects of the credit crunch in 2008 and the COVID-19 pandemic. We generally believe that data should only be excluded when the volatility relates to one-time events specific to the reporting company that are reasonably within the control of the company’s management or shareholders. Data related to events affecting the broader market should not be excluded from a company’s analysis, even when those events are considered extremely unlikely to recur. In addition, data from periods of significant stock price changes over a short period of time, that may occur due to lawsuits, failed product trials, or recalls, generally should not be excluded. When volatilities calculated based upon different measurement intervals (e.g., daily, weekly and/or monthly) differ significantly, a company may consider averaging the annualized volatility estimates from the different measurement intervals.

The average true range is a technical chart indicator that was created by J. ATR was originally developed for the commodity market, but it can be applied to any other financial market, including stocks, exchange-traded funds, forex, bonds, and futures. HV can be used to assess by how much the price of a security shifts from its average value.

How Do You Compute Historical Volatility?

When using a combination of various estimates, significant judgment is required to determine the relative weighting of the different measures. ASC 718 does not contain prescriptive guidance related to the weighting of estimates. According to SAB Topic 14, a company should consider all available information but may, under certain circumstances, rely exclusively on historical or implied volatility. Since the indicator makes use of actual price data that have been printed in the past for its calculation, it measures the historical volatility of the market in question. It does this by decomposing the entire range of an asset price for a period.

The Return of the Semis: 3 Semiconductor Securities to Navigate the Volatility – Yahoo Finance

The Return of the Semis: 3 Semiconductor Securities to Navigate the Volatility.

Posted: Thu, 23 Feb 2023 18:06:06 GMT [source]

The best way for further evaluation is to use a https://forexarena.net/ close to the period considered by most investors or traders. In other words, a higher-than-historical level of IV really is telegraphing the fact that the market thinks/hopes that the stock is about to move and, accordingly, is paying more for the option. While many options are bought to hedge short positions, a large percentage of them are bought to speculate on the underlying stock’s movement. In a very real sense, then, high IV acts as a speculation tax on traders; this is no more than market forces in operation. Once you establish a time frame, you need to determine the price intervals.

Calculate the Number of Trading Periods Per Year

Actually, as you can see on the volatility chart, 30 day historical volatility fell from 72% in October to 19.83% in March. Historical volatility is defined as the rate of dispersion of a financial asset over a certain period of time. In other words, it looks at how a price is deviating from the average. The most popular approach to find historical volatility is using standard deviation, which is a popular mathematical calculation. This measure is frequently compared with implied volatility to determine if options prices are over- or undervalued.

- One important point to note is that it shouldn’t be considered science, so it doesn’t provide a forecast of how the market will move in the future.

- Statistic that measures uncertainty and is used as an approximation to the historical market risk of a financial asset.

- Investments in stocks, options, ETFs and other instruments are subject to risks, including possible loss of the amount invested.

- According to SAB Topic 14, a company should consider all available information but may, under certain circumstances, rely exclusively on historical or implied volatility.

Regardless of which measurement frequency is selected, it should be used consistently for all awards. Implied volatility, unlike historical volatility, measures the market’s expectations of price fluctuations. It is estimated from the price of an option, so it is not based on the past performance of the underlying asset itself.

With https://trading-market.org/ volatility, traders use past trading ranges of underlying securities and indexes to calculate price changes. The most commonly traded options are in fact near-term, between 30 and 90 calendar days until expiration. So here’s a quick and dirty formula you can use to calculate a one standard deviation move over the lifespan of your option contract — no matter the time frame.

Volatility is generally a measure of the riskiness of an investment. Low volatility implies reduced uncertainty and risk, while high volatility is an indication of increased uncertainty and risk. Well, if the price is fluctuating rapidly, hitting new highs and lows very fast, the market may be considered highly volatile.

A Bollinger Band® is a momentum indicator used in technical analysis that depicts two standard deviations above and below a simple moving average. Obviously, knowing the probability of the underlying stock finishing within a certain range at expiration is very important when determining what options you want to buy or sell and when figuring out which strategies you want to implement. Conversely, if implied volatility decreases after your trade is placed, the price of options usually decreases. That’s good if you’re an option seller and bad if you’re an option owner.

Best Implied Volatility Indicators

Historical Volatility is a measure of how much price deviates from its average in a specific time period that can be set. Please note it does not measure the direction of price changes, just how volatile price has become. There are several reasons to care about volatility but it’s mainly a risk measure. As volatility increases, so does risk and uncertainty and vice versa. Traders can use the indicator to flag instruments with high volatility which could point to a trend change. Some authors point out that realized volatility and implied volatility are backward and forward looking measures, and do not reflect current volatility.

To address that issue an alternative, ensemble measures of volatility were suggested. One of the measures is defined as the standard deviation of ensemble returns instead of time series of returns. Another considers the regular sequence of directional-changes as the proxy for the instantaneous volatility. In options trading, HV is used as an approximate guide for how much volatility can be expected from the stock going forward.

- For example, to change a Plot containing EMA to EMA, first click on EMA, change the Period to 100, and click an ’Apply…’ button to save.

- On the other hand, the profit potential of a stock with high volatility will be increased.

- After a short pause you will see a horizontal line with two small end boxes.

- It oscillates based on a rating corresponding to the deviation from the moving average to indicate if crypto is volatile or stable.

- The value of investments may fluctuate and as a result, clients may lose the value of their investment.

Specifically, traders often look at a stock’s HV to determine whether or not options are pricing in a ”fair” amount of future volatility. Of course, since this is inherently an apples-to-oranges comparison, historical volatility is not always an accurate predictor of implied (or forward-looking) volatility. The table shows historical volatility for IBM calculated for different terms. As you can see 10-day historical volatility of 19.34% is relatively low, and 120-day historical volatility of 43.03% is relatively high. It means that a sharp decline in stock volatility occurred recently.

In Black-Scholes https://forexaggregator.com/s, the options would be considered highly overpriced. Historical volatility is an indicator of the extent to which a price may diverge from its average in a given period. Hence, increased price fluctuation results in a higher historical volatility value. It is important to keep in mind that the historical volatility figure does not indicate the price direction but rather how unstable a price is. When there is a rise in historical volatility, a security’s price will also move more than normal.